1. Signing Up for Too Many Cards

Yes, being qualified for a ton of credit cards is a great feeling, but having them enables you rack up large amounts of debt. While having multiple cards can help keep your credit utilization ratio in a proper range, it is a privilege that should be reserved for people with good organization skills. Usually, 1-2 cards should be enough; the only reason you should allow yourself to have any more is if your income can efficiently reflect your total credit available.

2. Paying Your Bill Late

Because history of paying credit card bills constitute for 35% of your credit score, paying your bill on time is another easily avoidable mistake. Such reckless behavior allows banks to raise interest rates and slap you with late fees. With technology so readily available, paying off your bills is literally just a matter of few seconds and a click. Conveniently, the CARD Act prohibits banks to raise the interest on existing balance until the card holder is 60 days past his/her due date. However, a new interest rate could get placed on transactions made after the 30 days past the due date. Bottom line, it’s not worth it.

3. Substituting it for Cash

Whipping out the plastic is a trend most of us are familiar with. We see our friends do it, we see it in the movies, heck we see the person in front of us in line do it. We know it’s easy and fast, but it is not the best habit when you’re trying to budget properly. Small transactions can slowly add up and can leave you stuck with a huge bill that you can’t pay off. Our advice, stick to cash for basic spending and if convenience is a factor, opt on using a debit card (just make sure you have the appropriate funds in it). Best part about resisting the urge to use your credit card, no buyer’s remorse!

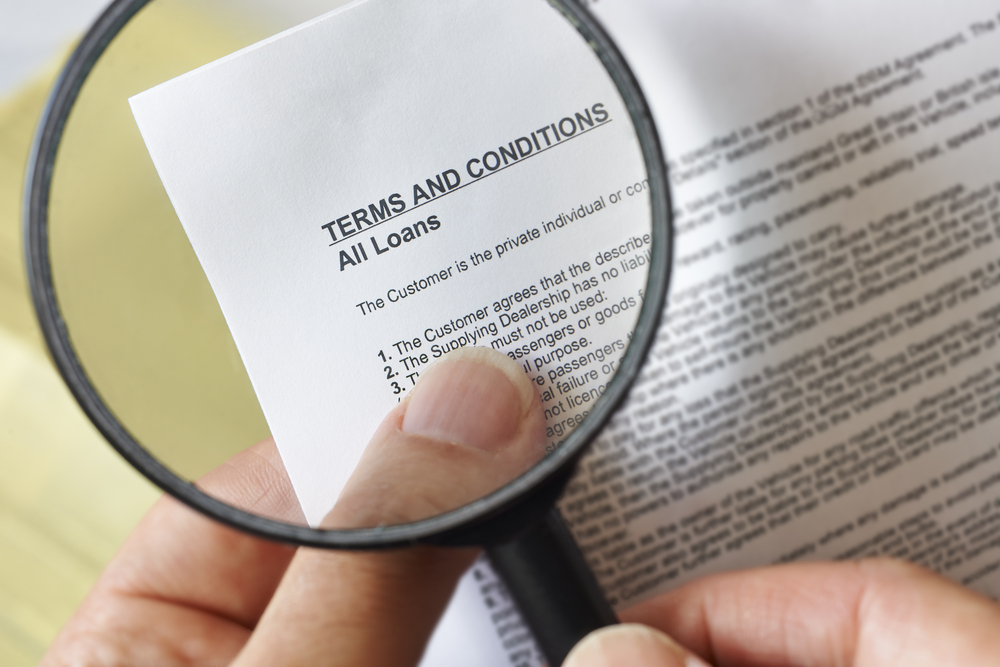

4. Knowing when the Introductory Offer Ends

Often times, the reason we sign up for a credit card is the initial deals or rewards that the banks offer. These deals and rewards are usually awesome and often times you just can’t say ‘no’ and credit card companies know this. So you have two choices- #1 don’t sign up for the card in the first place or #2 read the fine print. And while these perks are great, they don’t last forever, and many times they end without our knowledge. Certain beginner features like 0% APR are only in effect for a few pay periods so learn about them because often times the interest rate is much higher than you would assume.

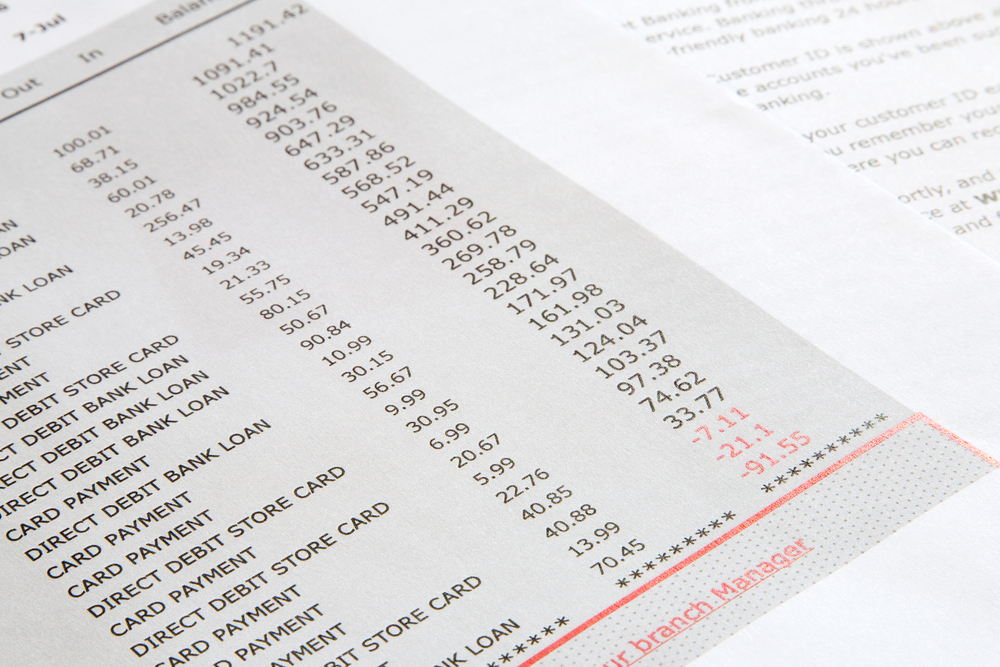

5. Ignoring Monthly Statements

Read your monthly statements, this is an easy one. Not only will reading your monthly statements help you properly control your budget and be in charge of your finances, but you will be able to keep an eye on any fraudulent activity that might have taken place. Identity theft is a very serious problem and all measures should be taken to protect yourself from it. In the last few years there have been so many retailers that have had their credit card databases hacked that practically everyone is at risk. Usually, you have 60 days to dispute claims but the sooner the better. Your best chance with proving that they aren’t yours are reporting them immediately.

6. Maxing Out Credit Cards

Everyone has done it at least once in their life, haven’t’ they? Maxing out a credit card is not only an embarrassing situation, but terrible for your credit. Thankfully, with the CARD Act in place, paying over the limit fees and charges is no longer a monetary problem but one that still requires you to address it immediately (we advise that you acquaint yourself with the provisions the Act has to offer regarding over-limit fees). Maxing out your credit cards also puts your credit utilization ratio in negative light; for those of you that aren’t aware you’re the credit utilization ratio is a tool lenders use to determine if you are capable of handling debts. It’s basically their way of evaluating if you are responsible enough to be lent money. Dividing your used credit by your total available credit gives you the credit utilization ratio – keeping the numbers between 10% and 30% is advised.

7. Making Only Minimum Payments

We know it’s painful to pay but making the minimum payments only puts a Band-Aid on the situation. Not only does the money add up towards your credit utilization ratio (see above) but if you don’t take care of balances as soon as possible, the high interest rates will force you to pay significantly higher than what you initially borrowed.

8. Taking Cash Advances

We wish a siren could go off when you start reading this one. Taking cash advances should be avoided at all costs; you are much better off borrowing the money from somebody…anybody! First of all, you will be paying a flat fee just for the service. Second, the interest rate will begin immediately with absolutely no grace period and in order to make it worth it you would have to pay the money practically right away. Also, interest on cash advances is much higher than regular rates.

9. Not Reading the Contract/the Fine Print

We are pretty sure at some point everyone has been told this in their life “read the fine print”, this holds true for credit cards. Just like any contract, you must read and learn all the details. There is nothing worse than getting hit with a penalty you that you ‘think’ did not exist because you didn’t ‘know’ about it (note saying that to the company won’t make a bit of difference). You must be thoroughly familiar with all the information regarding your card such as the APR, the fees on certain transactions, the penalties, and the expiration on certain reward programs.

10. Closing Old Credit Cards

While having a slew of credit card in your arsenal is a bad idea, so is closing the ones you already have. 15% of you credit score is directly linked with your credit history, so by removing an old card with multiple transactions, you are essentially deleting a portion of your credit history, and your credit score. Plus, doing so will reduce your overall credit limit which will then affect your credit utilization ratio (it all goes back to this number). The best option is to place it in a secure location and only using it for emergencies.